Like the retail FX industry, Institutional FX is also undergoing relentless structural upheaval. Much of this is driven by technology advances, new operating models, evolving credit intermediation approaches and the emergence and proliferation of non-bank liquidity providers and ECN’s in the wake of Dodd Frank, the Volcker Rule and best-execution compliance.

Bilateral credit isn’t what it used to be either. In the new many-to-many liquidity model, the traditional (price) maker and taker roles have become even more blurred. Once the exclusive domain of the investment banks (D2D), FX liquidity these days is cycled and recycled through a plethora of non-bank LP’s, aggregators, ECN’s and brokers in the new many to many liquidity distribution model.

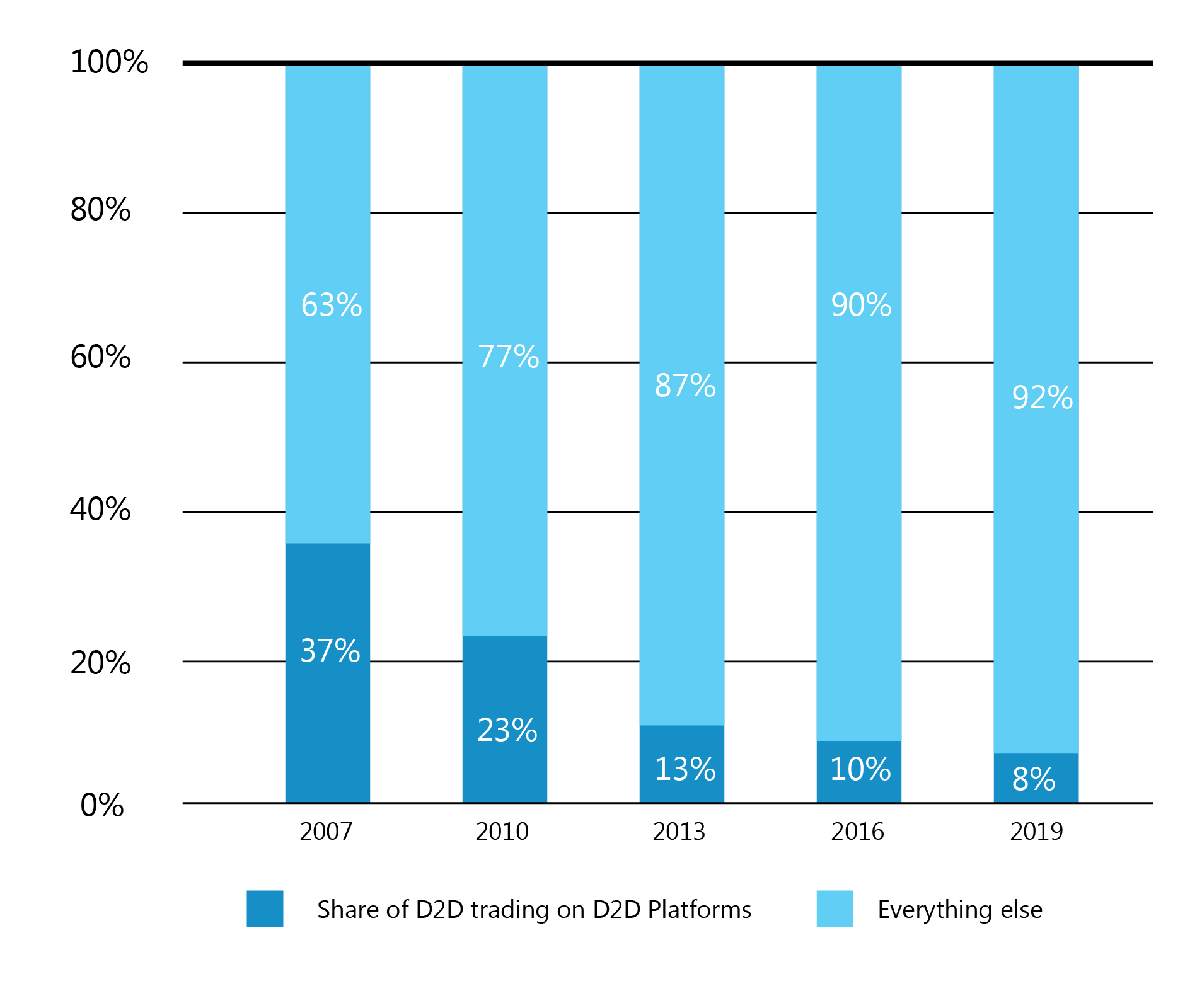

Fig. 1 Share of D2D trading on D2D platforms as a percentage of ADV – global FXSource: BIS and JPL Research paper

And it’s not just the sell side and demise of the D2D and D2C market making franchise model. Armed with prime broking and prime of prime facilities, retail brokers as a sectoral collective now account for around 15% of the $4.5 trillion/day global FX industry and is still generating CAGR > 30% pa.

In such a dynamic credit, clearing and liquidity distribution environment, operating models and technology stacks/partners will inevitably and necessarily evolve. In pursuit of operational and margin efficiency, precisely how, where and when liquidity is accessed, flow cleared and collateral managed, remain critical determinants of success.

Anyone who has been in the markets for a while knows that the FX industry has this innate ability to continually re-invent itself. This is no more evident than in the Institutional space.